Advertisement

-

Published Date

June 30, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

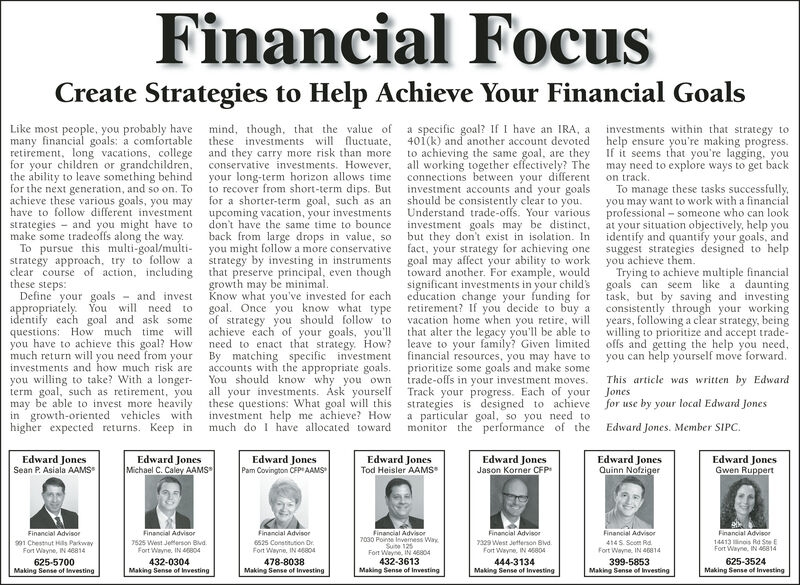

Financial Focus Create Strategies to Help Achieve Your Financial Goals Like most people, you probably have mind, though, that the value of a specific goal? If I have an IRA, a investments within that strategy to many financial goals: a comfortable these investments will fluctuate, 401(k) and another account devoted help ensure you're making progress. retirement, long vacations, college and they carry more risk than more for your children or grandchildren, conservative investments. However, the ability to leave something behind your long-term horizon allows time to recover from short-term dips. But for a shorter-term goal, such as an upcoming vacation, your investments don't have the same time to bounce back from large drops in value, so To pursue this multi-goal/multi- you might follow a more conservative strategy by investing in instruments to achieving the same goal, are they If it seems that you're lagging, you all working together effectively? The may need to explore ways to get back connections between your different on track. investment accounts and your goals should be consistently clear to you. Understand trade-offs. Your various professional - someone who can look investment goals may be distinct, but they don't exist in isolation. In fact, your strategy for achieving one goal may affect your ability to work To manage these tasks successfully. you may want to work with a financial for the next generation, and so on. To achieve these various goals, you may have to follow different investment strategies - and you might have to make some tradeoffs along the way. at your situation objectively, help you identify and quantify your goals, and suggest strategies designed to help you achieve them. Trying to achieve multiple financial strategy approach, try to follow a clear course of action, including that preserve principal, even though toward another. For example, would these steps: Define your goals appropriately. You will need to identify each goal and ask some questions: How much time will you have to achieve this goal? How much return will you need from your investments and how much risk are you willing to take? With a longer- term goal, such as retirement, you may be able to invest more heavily these questions: What goal will this strategies is designed to achieve in growth-oriented vehicles with higher expected returns. Keep in growth may be minimal. significant investments in your child's goals can seem like a daunting education change your funding for retirement? If you decide to buy a vacation home when you retire, will that alter the legacy you'll be able to willing to prioritize and accept trade- leave to your family? Given limited financial resources, you may have to Know what you've invested for each goal. Once you know what type of strategy you should follow to achieve each of your goals, you'll need to enact that strategy. How? By matching specific investment task, but by saving and investing consistently through your working years, following a clear strategy, being and invest offs and getting the help you need, you can help yourself move forward. accounts with the appropriate goals. prioritize some goals and make some You should know why you own trade-offs in your investment moves. This article was written by Edward all your investments. Åsk yourself Track your progress. Each of your Jones for use by your local Edward Jones investment help me achieve? How much do I have allocated toward a particular goal, so you need to monitor the performance of the Edward Jones. Member SIPC. Edward Jones Sean P. Asiala AAMS Edward Jones Michael C. Caley AAMS Edward Jones Pam Covington CFP AAMS Edward Jones Tod Heisler AAMS Edward Jones Jason Korner CFP Edward Jones Quinn Nofziger Edward Jones Gwen Ruppert Financial Advisor 7329 West Jefterson Bvd. Fort Weyne, IN M804 Financial Advisor Financial Advisor Financial Advisor Financial Advisor 7030 Poinse Inverness Way Suite 125 Fort Weyne, IN 04 432-3613 Making Sense of Investing Financial Advisor s01 Chestnut Hils Parkway Fort Wayne, IN 46814 7525 West Jetterson Bivd. Fort Wayne. IN s804 6525 Constitution Dr. Fort Weyne, IN 46804 414S. Scott Rd Fort Wayne. IN 46814 Financial Advipor 14413 inois Rd Ste E Fort Wayne. IN 814 625-5700 Making Sense of Investing 432-0304 Making Sense of Investing 478-8038 Making Sense of Investing 444-3134 Making Sense of Investing 399-5853 Making Sense of Investing 625-3524 Making Sense of Investing Financial Focus Create Strategies to Help Achieve Your Financial Goals Like most people, you probably have mind, though, that the value of a specific goal? If I have an IRA, a investments within that strategy to many financial goals: a comfortable these investments will fluctuate, 401(k) and another account devoted help ensure you're making progress. retirement, long vacations, college and they carry more risk than more for your children or grandchildren, conservative investments. However, the ability to leave something behind your long-term horizon allows time to recover from short-term dips. But for a shorter-term goal, such as an upcoming vacation, your investments don't have the same time to bounce back from large drops in value, so To pursue this multi-goal/multi- you might follow a more conservative strategy by investing in instruments to achieving the same goal, are they If it seems that you're lagging, you all working together effectively? The may need to explore ways to get back connections between your different on track. investment accounts and your goals should be consistently clear to you. Understand trade-offs. Your various professional - someone who can look investment goals may be distinct, but they don't exist in isolation. In fact, your strategy for achieving one goal may affect your ability to work To manage these tasks successfully. you may want to work with a financial for the next generation, and so on. To achieve these various goals, you may have to follow different investment strategies - and you might have to make some tradeoffs along the way. at your situation objectively, help you identify and quantify your goals, and suggest strategies designed to help you achieve them. Trying to achieve multiple financial strategy approach, try to follow a clear course of action, including that preserve principal, even though toward another. For example, would these steps: Define your goals appropriately. You will need to identify each goal and ask some questions: How much time will you have to achieve this goal? How much return will you need from your investments and how much risk are you willing to take? With a longer- term goal, such as retirement, you may be able to invest more heavily these questions: What goal will this strategies is designed to achieve in growth-oriented vehicles with higher expected returns. Keep in growth may be minimal. significant investments in your child's goals can seem like a daunting education change your funding for retirement? If you decide to buy a vacation home when you retire, will that alter the legacy you'll be able to willing to prioritize and accept trade- leave to your family? Given limited financial resources, you may have to Know what you've invested for each goal. Once you know what type of strategy you should follow to achieve each of your goals, you'll need to enact that strategy. How? By matching specific investment task, but by saving and investing consistently through your working years, following a clear strategy, being and invest offs and getting the help you need, you can help yourself move forward. accounts with the appropriate goals. prioritize some goals and make some You should know why you own trade-offs in your investment moves. This article was written by Edward all your investments. Åsk yourself Track your progress. Each of your Jones for use by your local Edward Jones investment help me achieve? How much do I have allocated toward a particular goal, so you need to monitor the performance of the Edward Jones. Member SIPC. Edward Jones Sean P. Asiala AAMS Edward Jones Michael C. Caley AAMS Edward Jones Pam Covington CFP AAMS Edward Jones Tod Heisler AAMS Edward Jones Jason Korner CFP Edward Jones Quinn Nofziger Edward Jones Gwen Ruppert Financial Advisor 7329 West Jefterson Bvd. Fort Weyne, IN M804 Financial Advisor Financial Advisor Financial Advisor Financial Advisor 7030 Poinse Inverness Way Suite 125 Fort Weyne, IN 04 432-3613 Making Sense of Investing Financial Advisor s01 Chestnut Hils Parkway Fort Wayne, IN 46814 7525 West Jetterson Bivd. Fort Wayne. IN s804 6525 Constitution Dr. Fort Weyne, IN 46804 414S. Scott Rd Fort Wayne. IN 46814 Financial Advipor 14413 inois Rd Ste E Fort Wayne. IN 814 625-5700 Making Sense of Investing 432-0304 Making Sense of Investing 478-8038 Making Sense of Investing 444-3134 Making Sense of Investing 399-5853 Making Sense of Investing 625-3524 Making Sense of Investing