Advertisement

-

Published Date

January 1, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

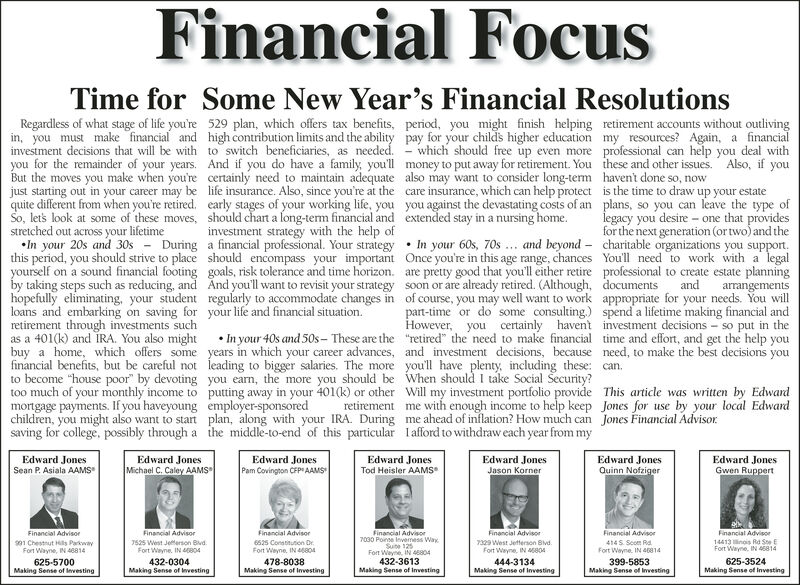

Financial Focus Some New Year's Financial Time for Resolutions Regardless of what stage of life you're 529 plan, which offers tax benefits, period, you might finish helping retirement accounts without outliving in, you must make financial and high contribution limits and the ability pay for your childs higher education my resources? Again, a financial investment decisions that will be with to switch beneficiaries, as needed. - which should free up even more professional can help you deal with you for the remainder of your years. And if you do have a family, you'll money to put away for retirement. You these and other issues. Also, if you But the moves you make when you're certainly need to maintain adequate also may want to consider long-term havent done so, now just starting out in your career may be life insurance. Also, since you're at the care insurance, which can help protect is the time to draw up your estate quite different from when you're retired. early stages of your working life, you you against the devastating costs of an plans, so you can leave the type of So, lets look at some of these moves, should chant a long-tem financial and extended stay in a nursing home. stretched out across your lifetime In your 20s and 30s - During a financial professional. Your strategy In your 60s, 70s .. and beyond - charitable organizations you support. this period, you should strive to place should encompass your important Once you're in this age range, chances You'll need to work with a legal yourself on a sound financial footing goals, risk tolerance and time horizon. are pretty good that you'll either retire professional to create estate planning by taking steps such as reducing, and And you'll want to revisit your strategy soon or are already retired. (Although, documents hopefully eliminating, your student regularly to accommodate changes in of course, you may well want to work appropriate for your needs. You will loans and embarking on saving for your life and financial situation. retirement through investments such as a 401(k) and IRA. You also might buy a home, which offers some years in which your career advances, and investment decisions, because need, to make the best decisions you financial benefits, but be careful not leading to bigger salaries. The more you'll have plenty, including these: can. to become "house poor" by devoting you earn, the more you should be When should I take Social Security? too much of your monthly income to putting away in your 401(k) or other Will my investment portfolio provide This article was written by Edward mortgage payments. If you haveyoung employer-sponsored children, you might also want to start plan, along with your IRA. During me ahead of inflation? How much can Jones Financial Advisor. saving for college, possibly through a ihe middle-to-end of this particular lafford to withdraw each year from my legacy you desire - one that provides for the next generation (or two) and the investment strategy with the help of and arrangements part-time or do some consulting.) spend a lifetime making financial and However, you certainly havent investment decisions - so put in the "retired" the need to make financial time and effort, and get the help you In your 40s and 50s- These are the retirement me with enough income to help keep Jones for use by your local Edward Edward Jones Edward Jones Michael C. Caley AAMS Edward Jones Pam Covington CFP" AAMS Edward Jones Tod Heisler AAMS Edward Jones Jason Korner Edward Jones Quinn Nofziger Edward Jones Gwen Ruppert Sean P. Asiala AAMS Financial Advisor Financial Advisor 7329 West Jetterson Bvd Fort Weyne, IN 4G804 Financial Advisor 414S. Scom Rd Fort Wayne. IN 40014 Financial Advisor Financial Advisor 7030 Ponse Inveness Way Suite 125 Fort Weyne, IN 46804 432-3613 Making Sense of Investing Financial Advisor 14413 linois Rd Ste E Fort Wayne, IN 46814 Financial Advisor s01 Chestnut Hls Parkway Fort Wayne, IIN 46814 7525 West Jetterson Bivd. Fort Wayne. IN 40e04 6525 Constitution Dr. Fort Weyne, IN 46804 625-3524 Making Sense of Investing 625-5700 Making Sense of Investing 432-0304 478-8038 Making Sense of Investing 444-3134 Making Sense of Investing 399-5853 Making Sense of Investing Making Sense of Investing Financial Focus Some New Year's Financial Time for Resolutions Regardless of what stage of life you're 529 plan, which offers tax benefits, period, you might finish helping retirement accounts without outliving in, you must make financial and high contribution limits and the ability pay for your childs higher education my resources? Again, a financial investment decisions that will be with to switch beneficiaries, as needed. - which should free up even more professional can help you deal with you for the remainder of your years. And if you do have a family, you'll money to put away for retirement. You these and other issues. Also, if you But the moves you make when you're certainly need to maintain adequate also may want to consider long-term havent done so, now just starting out in your career may be life insurance. Also, since you're at the care insurance, which can help protect is the time to draw up your estate quite different from when you're retired. early stages of your working life, you you against the devastating costs of an plans, so you can leave the type of So, lets look at some of these moves, should chant a long-tem financial and extended stay in a nursing home. stretched out across your lifetime In your 20s and 30s - During a financial professional. Your strategy In your 60s, 70s .. and beyond - charitable organizations you support. this period, you should strive to place should encompass your important Once you're in this age range, chances You'll need to work with a legal yourself on a sound financial footing goals, risk tolerance and time horizon. are pretty good that you'll either retire professional to create estate planning by taking steps such as reducing, and And you'll want to revisit your strategy soon or are already retired. (Although, documents hopefully eliminating, your student regularly to accommodate changes in of course, you may well want to work appropriate for your needs. You will loans and embarking on saving for your life and financial situation. retirement through investments such as a 401(k) and IRA. You also might buy a home, which offers some years in which your career advances, and investment decisions, because need, to make the best decisions you financial benefits, but be careful not leading to bigger salaries. The more you'll have plenty, including these: can. to become "house poor" by devoting you earn, the more you should be When should I take Social Security? too much of your monthly income to putting away in your 401(k) or other Will my investment portfolio provide This article was written by Edward mortgage payments. If you haveyoung employer-sponsored children, you might also want to start plan, along with your IRA. During me ahead of inflation? How much can Jones Financial Advisor. saving for college, possibly through a ihe middle-to-end of this particular lafford to withdraw each year from my legacy you desire - one that provides for the next generation (or two) and the investment strategy with the help of and arrangements part-time or do some consulting.) spend a lifetime making financial and However, you certainly havent investment decisions - so put in the "retired" the need to make financial time and effort, and get the help you In your 40s and 50s- These are the retirement me with enough income to help keep Jones for use by your local Edward Edward Jones Edward Jones Michael C. Caley AAMS Edward Jones Pam Covington CFP" AAMS Edward Jones Tod Heisler AAMS Edward Jones Jason Korner Edward Jones Quinn Nofziger Edward Jones Gwen Ruppert Sean P. Asiala AAMS Financial Advisor Financial Advisor 7329 West Jetterson Bvd Fort Weyne, IN 4G804 Financial Advisor 414S. Scom Rd Fort Wayne. IN 40014 Financial Advisor Financial Advisor 7030 Ponse Inveness Way Suite 125 Fort Weyne, IN 46804 432-3613 Making Sense of Investing Financial Advisor 14413 linois Rd Ste E Fort Wayne, IN 46814 Financial Advisor s01 Chestnut Hls Parkway Fort Wayne, IIN 46814 7525 West Jetterson Bivd. Fort Wayne. IN 40e04 6525 Constitution Dr. Fort Weyne, IN 46804 625-3524 Making Sense of Investing 625-5700 Making Sense of Investing 432-0304 478-8038 Making Sense of Investing 444-3134 Making Sense of Investing 399-5853 Making Sense of Investing Making Sense of Investing