Advertisement

-

Published Date

November 29, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

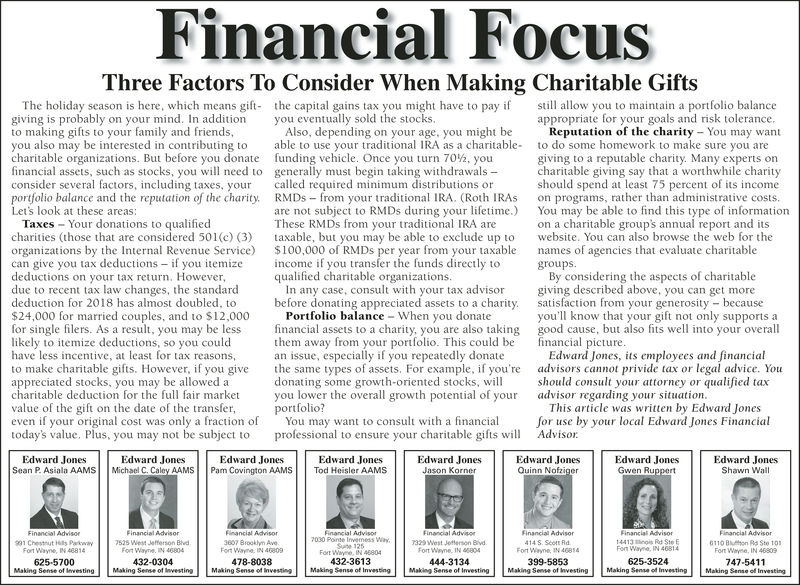

Financial Focus Three Factors To Consider When Making Charitable Gifts The holiday season is here, which means gift the capital gains tax you might have to pay if aow you to maintain a portfolio balance giving is probably on your mind. In additn you eventually sold the stocks. to making gifts to your family and friends you also may be interested in contributing to appropriate for your goals and risk tolerance Also, depending on your age, you might be able to use your traditional IRA as a charitable- charitable organizations. But before you donate funding vehicle. Once you turn 70½, you financial assets, such as stocks, you will need to generally must begin taking withdrawals - consider several factors, including taxes, you clled required minimum distributions or Reputation of the charity - You may want to do some homework to make sure you are giving to a reputable charity. Many experts on charitable giving say tat a worthwhile charity should spend at least 75 percent of its income portfolio balance and the reputation of the charity RMDs from your traditional IRA. (Roth IRAs on programs, rather than administrative costs. Let's look at these areas: are not subject to RMDs during your lifetime) You may be able to find this type of information These RMDs from your traditional IRA are Taxes Your donations to qualified on a charitable groups annual report and its charities (those that are considered 501(c) (3) axable, but you may be able to exclude up to ebsite. You can also browse the web for the organizations by the Internal Revenue Service 100,000 of RMDs per year from your taxable ames of agencies that evaluate charitable can give you tax deductions - if you itemize come if you transfer the funds directly to qualified charitable organizations. deductions on your tax return. However due to recent tax law changes, the standard deduction for 2018 has almost doubled, to By considering the aspects of charitable giving described above, you can get more In any case, consult with your tax advisor before donating appreciated assets to a charity sasfaction from your generosity because $24,000 for married couples, and to $12,000 for single filers. As a result, you may be less likely to itemize deductions, so you could have less incentive, at least for tax reasons, Portfolio balance When you donat them away from your portfolio. This could be fiancial picture donating some growth-oriented stocks, portfolio? you'll know that your gift not only supports a good cause, but also fits well into your overall financial assets to a charity, you are also taking Edward Jones, ts employees and financial to make charitable gifts. However, if you give e same types of assets. For example, f you're advisors cannot privide tax or legal advice. You you lower the overall growth potential of your You may want to consult with a financial appreciated stocks, you may be allowed a charitable deduction for the full fair market value of the gift on the date of the transfer even if your original cost was only a fraction of should consult your attorney or qualified tax advisor regarding your situation This article was written by Edward Jones for use by your local Edward Jones Financial today's value. Plus, you may not be subject to professional to ensure your charitable gifts Advisor Edward Jones Sean P. Asiala AAMS Michael C. Caley AAMS Edward Jones Edward Jones Pam Covington AAMS Tod Heisler AAMS Edward Jones Edward Jones Jason Korner ard J Quinn Nofziger Edward Jones Shawn Wall 030 Pointe Invemess Way, Fort Wayne. IN 46809 478-8038 Making Sense of Investing Making Sense of Investing Making Sense of Iinvesting Making Sense of InvestingMaking Sense of Investing 7525 West Jefferson Bld Fort Wayme. IN 46804 432-0304 329 West Jetterson Bivd Fort Weyne IN 85804 4413 ois Rd Ste E Font Wayre, IN 46814 110 Bon Rd Ste 10 Fort Wayne, IN 46809 Fort Wayne, I 48814 Fort Wryne, IN 46854 399-5853 625-5700 432-3613 444-3134 625-3524 747-5411 Making Sense of Investing Making Sense of Investing Making Sense of Investing