Advertisement

-

Published Date

December 6, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

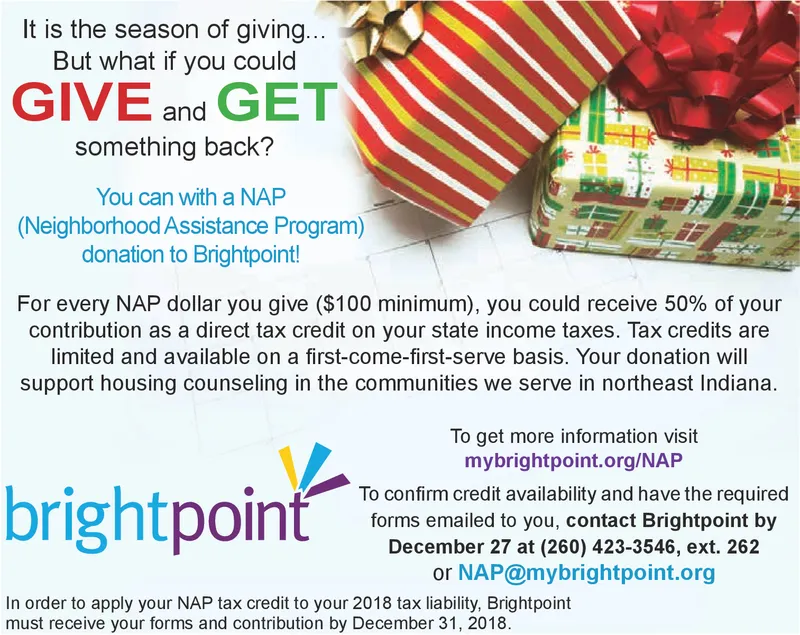

It is the season of giving But what if you could GIVE and GET something back? You can with a NAP (Neighborhood Assistance Program) donation to Brightpoint! For every NAP dollar you give ($100 minimum), you could receive 50% of your contribution as a direct tax credit on your state income taxes. Tax credits are limited and available on a first-come-first-serve basis. Your donation will support housing counseling in the communities we serve in northeast Indiana. To get more information visit mybrightpoint.org/NAP To confirm credit availability and have the required forms emailed to you, contact Brightpoint by December 27 at (260) 423-3546, ext. 26:2 or NAP@mybrightpoint.org In order to apply your NAP tax credit to your 2018 tax liability, Brightpoint must receive your forms and contribution by December 31, 2018.